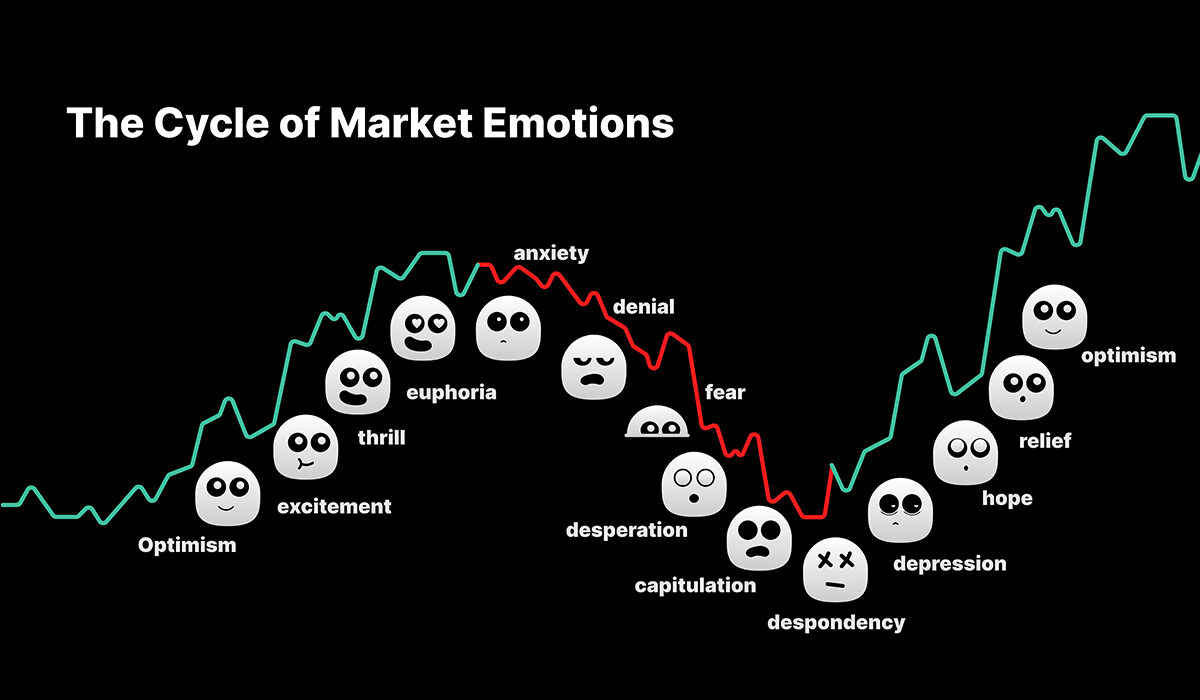

Financial market trading is frequently perceived as a solely analytical and data-driven activity. However, as trading is fundamentally a human activity, emotions play a role in it. In trading, emotional choices can result in losses, missed chances, and stress. One can develop techniques to make more logical and successful trading judgments by developing an awareness of how emotions affect trading. These are the four main ways that feelings impact trading:

1. Overconfidence and Euphoria

It’s typical to feel unstoppable following a string of successful trades. This emotion, which is usually referred to as overconfidence, might influence traders to open larger positions or trade more frequently because they believe their winning streak will never end.

Losses can still happen to any trader or strategy, though. Overconfidence can make a trader blind to potential risks and make them miss important warning flags. Such traders might experience substantial losses if a downturn does materialize, setting them up for the next emotional trap.

2. Fear and Panic

Traders can readily descend into a spiral of fear and panic during downturns, just as they can easily experience euphoria during prosperous times. Fear can impair judgment when a trade start moving against a trader. A scared trader may choose to stick onto a losing position in the hopes that it will reverse, rather than evaluating the situation logically and selecting the best course of action (such cutting losses early).

The worst-case scenario is when this dread can develop into panic, causing traders to sell their positions carelessly, frequently leading to unneeded losses. Additionally, panic selling can make market downturns worse by driving prices even lower as a result of a flood of sellers.

3. Anchoring Bias

When making decisions, people have a propensity to place a lot of weight on the first piece of information they come across (the “anchor”). This can show up in trading as a sentimental attachment to the price at which a security was purchased or sold. A trader who bought a stock at $100, for instance, could be reluctant to sell it at $95, even though all the signs point to further deterioration. They become emotionally attached to the purchase price and, despite the chances against it, they can continue to hold out hope that the stock would rise to that level.

4. Herd Mentality

Humans are naturally sociable beings, and this trait carries over to the trade floor. Traders frequently use other people’s conduct to support their own judgments. A stock must be a solid investment if everyone else is purchasing it, right? No, never. This tendency to follow the crowd can exacerbate crashes and blow-up bubbles.

Understanding the general market mood is crucial, but simply going along with the flow might backfire. The drama and excitement of a busy market can enthrall emotional traders, causing them to make decisions they may come to regret.